Learn to Follow the institutions using Price Action

Learn Price Action Concepts with Logic

Even If You Are A Beginner or Experienced Professional

Date

21st Feb 25

Time

07:55 PM

- with Ravhi RM Chandiramanii

India’s Leading Stock Market Coach

“Trading ke is Mahabharat me Ravhi Sir Krishna bankar hame marg dikha rahe hain…world best teacher”

- Kapil Goyal

HURRY! 77.33% Seats Filled

What will you learn in 2 Hours?

#1

Trading Mindset

Most traders lose capital due to a get-quick rich mindset or lack of emotional control. To succeed, start with small capital and keep realistic profit expectations.

In our webinar, we’ll help you develop the right mindset for long-term trading success.

#2

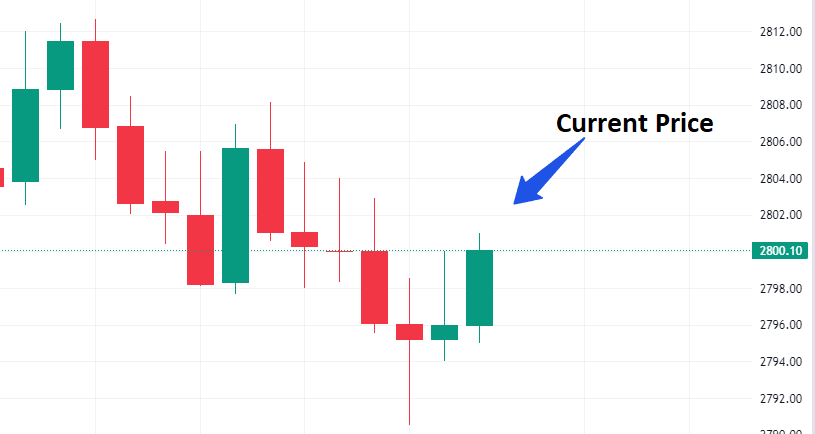

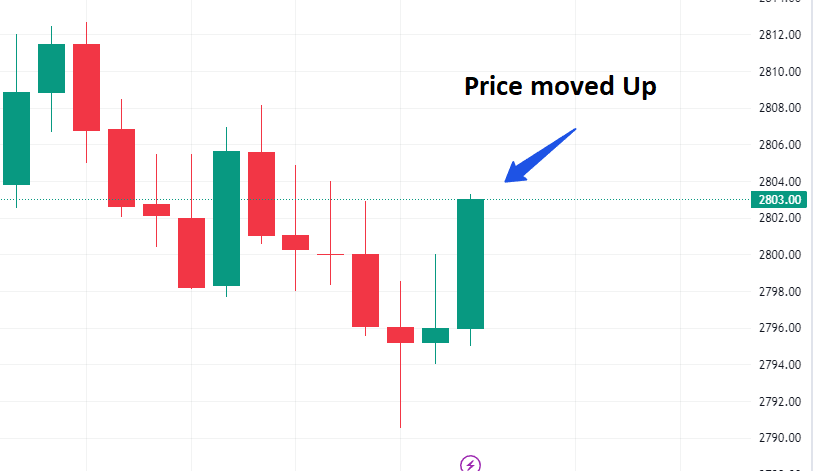

How Price Moves

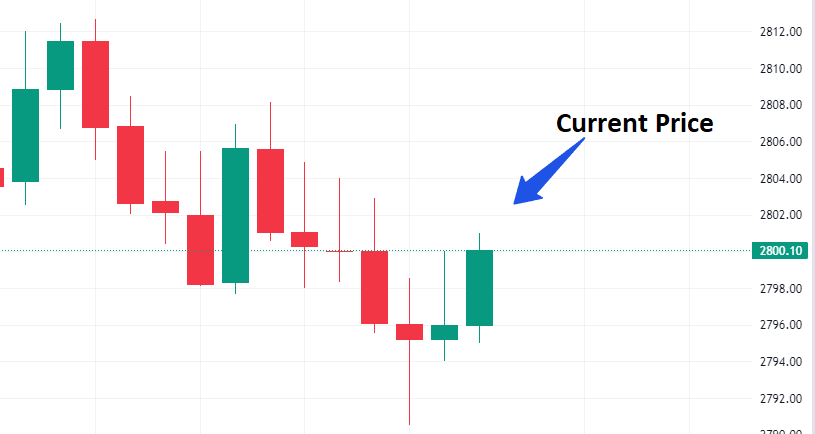

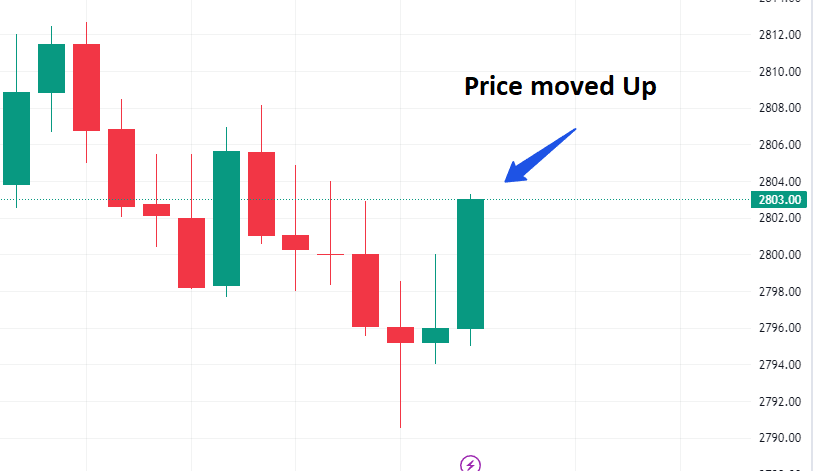

Prices fluctuate rapidly in live market. For example, in the first image, the stock price is ₹2800, and in the second, it has moved to ₹2803. Understanding why and how prices rally or fall is crucial for making informed trades.

We’ll cover this in detail during the workshop.

#3

Price Action Concepts with Logics

Support Becomes Resistance & Vice Versa

This concept works when buyers get trapped after a breakdown. However, if buyers move along support without getting trapped, the concept support becomes resistance may not work.

This is just one example—we’ll explore multiple price action logics in the webinar to help refine your decision-making.

#4

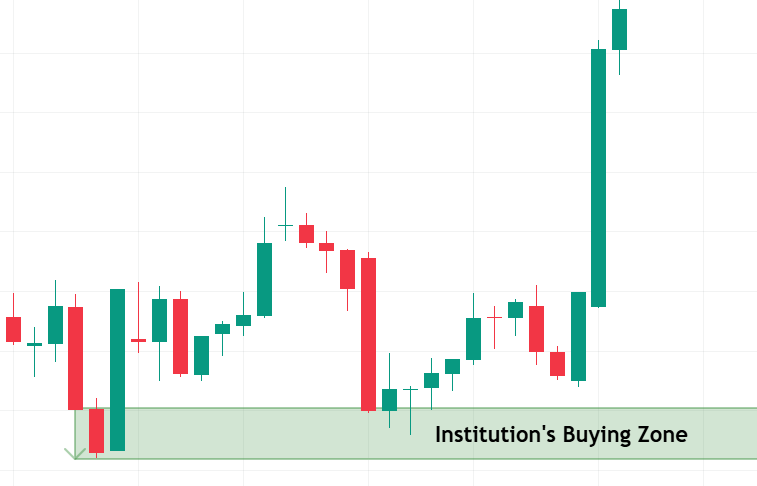

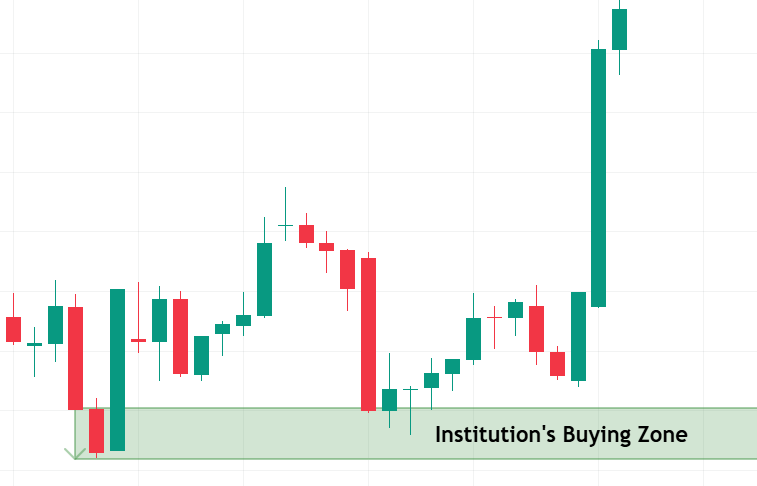

Institution's Buying and Selling Zones

Institutions are the market movers. If you seriously want to build your trading career, you must follow their footprints.

This means identifying institutional buying and selling zones—a key skill we’ll teach you in the webinar using real market examples.

#5

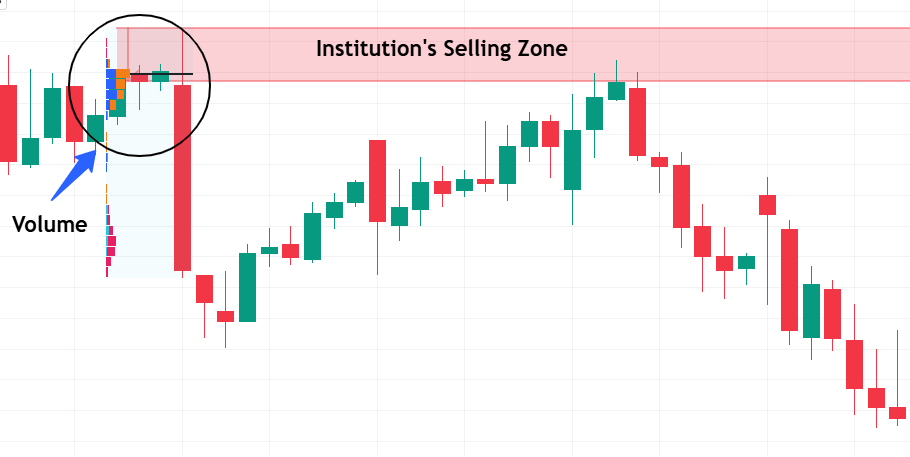

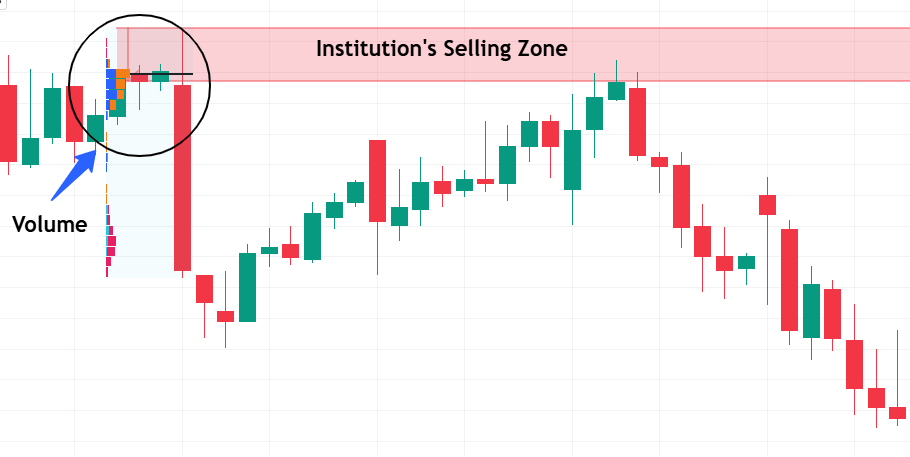

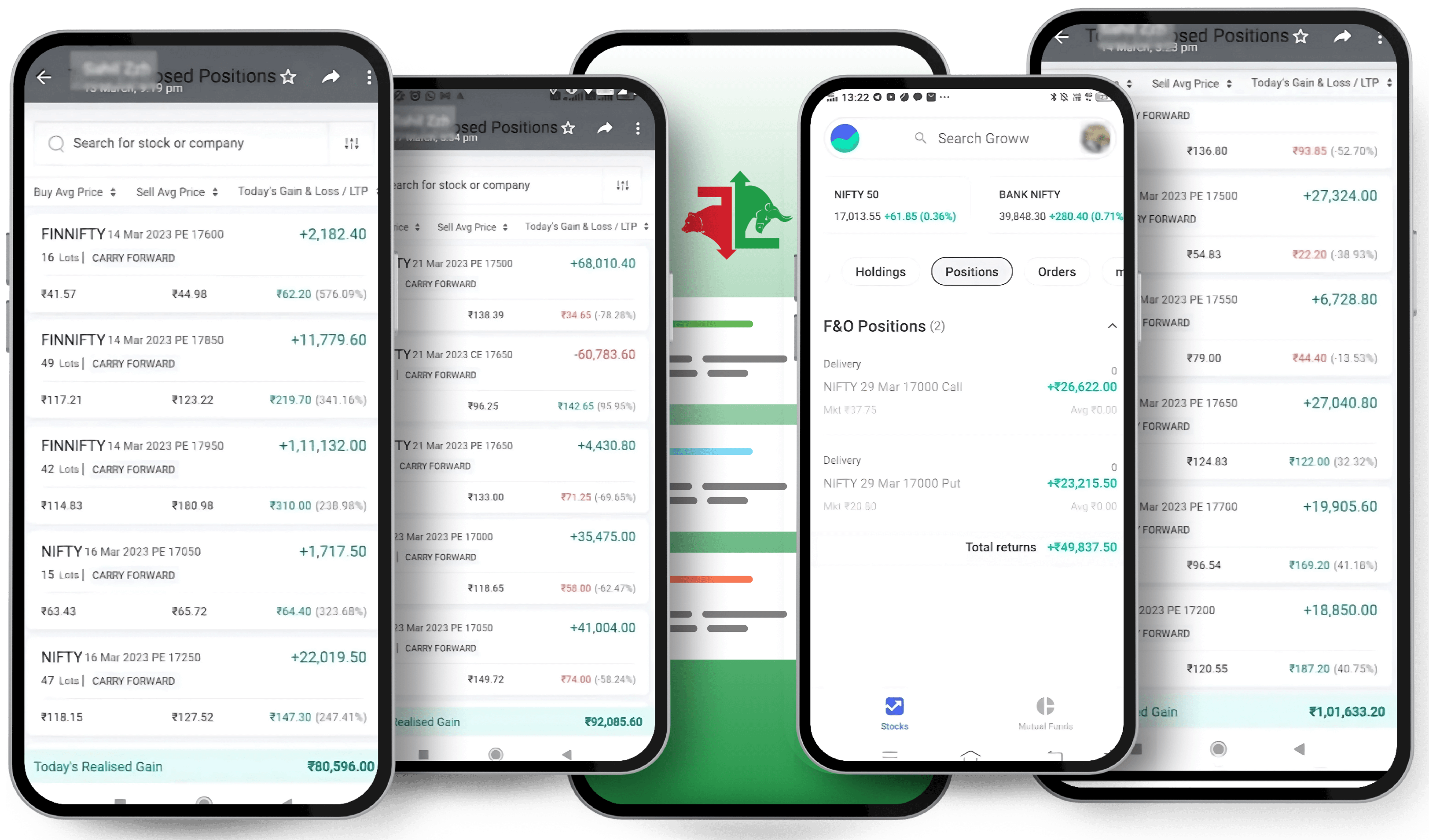

Proof of Institutions Buying and Selling at their zones

Traditional volume indicators don’t always reveal institutional activity accurately. That’s why we use Volume Profile, highlighting areas where institutions have placed significant orders (as shown in the images).

In the webinar, we’ll show you how to spot institutional buying and selling zones so you can align your trades with smart money.

HURRY! 77.33% Seats Filled

What will you learn in 2 Hours?

#1

Trading Mindset

Most traders lose capital due to a get-quick rich mindset or lack of emotional control. To succeed, start with small capital and keep realistic profit expectations.

In our webinar, we’ll help you develop the right mindset for long-term trading success.

#2

How Price Moves

Prices fluctuate rapidly in live market. For example, in the first image, the stock price is ₹2800, and in the second, it has moved to ₹2803. Understanding why and how prices rally or fall is crucial for making informed trades.

We’ll cover this in detail during the workshop.

#3

Price Action Concepts with Logics

Support Becomes Resistance & Vice Versa.

This concept works when buyers get trapped after a breakdown. However, if buyers move along support without getting trapped, the concept support becomes resistance may not work.

This is just one example—we’ll explore multiple price action logics in the webinar to help refine your decision-making.

#4

Institution's Buying and Selling Zones

Institutions are the market movers. If you seriously want to build your trading career, you must follow their footprints.

This means identifying institutional buying and selling zones—a key skill we’ll teach you in the webinar using real market examples.

#5

Proof of Institutions Buying and Selling at their zones

Traditional volume indicators don’t always reveal institutional activity accurately. That’s why we use Volume Profile, highlighting areas where institutions have placed significant orders (as shown in the images).

In the webinar, we’ll show you how to spot institutional buying and selling zones so you can align your trades with smart money.

HURRY! 77.33% Seats Filled

Is This Happening With You?

- Even after trying multiple strategies, I'm not able to earn consistently from the stock market

- I have a small capital, how should I start?

- I don't know how to find out the right Entry & Exit points

- I get emotional while making decisions in a LIVE Market

- It feels too risky to make Trading a full-time career

- Which strategy to choose from thousands of Strategies?

- I lack the right mindset to build a lasting career in trading

- I don't know how to Trade

- I have left Trading because of losses

- I am absolutely a beginner & want to learn from scratch

Meet Your Mentor

RAVHI RM CHANDIRAMANII

India's Leading Stock Market Coach

Ravhi RM Chandiramanii is recognized as a leading authority in turning Novice Traders into Professional Traders.

In Few years, he has successfully transformed his trading experience into a thriving platform; Trade Legend which is for people to master the Trading Skills & become Professional Trader.

He is synonymous with success, crazy passionate about numbers & the Stock market. His practical approach and in-depth analysis over the past years of trading have made him successful today.

Ravhi took his guidance from an "International Mentor" & read almost 100+ trading books which helped him through his journey.

His platform- Trade Legend, has empowered countless individuals to turn trading into a successful career

Sourav Ganguly

Skilling India Award

Awarded for being One of the Top Performers across India.

- Felicitated by Sourav Ganguly

Irfan Pathan

Special Guest Appearance

Indian former Cricket and Professional Coach gracing at our Event

CEO of Classplus

Platinum Educator Award

Awarded at Class plus, among all the Educators.

- Felicitated by CEO of Class plus

Shreyas Talpade:

Award of Consistency

Awarded for Putting Consistent Efforts for Upgrading trading skills in India.

-Felicitated by Shreyas Talpade

Mandira Bedi:

Award of Excellence

Awarded for Being an Awesome Trainer in Trading Niche.

- Felicitated by Mandira Bedi

HURRY! 77.33% Seats Filled

Real People, Real Reviews

Mr. Narayan. P

SIR KAL AAP BIG LOSS SE BANCHA DIYA, CROMPTON NOV PE SELL ACTIVE HO GAYA THA, HEDGE K LIYE PE BUY NAHI MIL RAHA THA. TOB FULLY CONFUSE THA, BROKER KO CALL KIYA O BOLE HOLD KORO KAL NIKAL JANA> EYE CLOSE KIYA AUR AAP KO YAAD KIYA. THEN SUDDENLY AAP KA AWAJ THOUGHT K JARIA AAYA---- NAKED OPTION KOVI VI HOLD NAHI KORNA CHAHIAAAA.... THEN 4.5K LOSS PE NIKAL GAYA, THANKS MERE GURU🙏🏻🙏🏻🙏🏻

Mr. Chatrapal Dansena

Apki videos dekhne k bad pura mera stock market ko dekhne ka nazriya hi Badal gya sir bahot hi deep knowledge or logic ke sath sare concept and douts ko clear krte ho apke jaise koi teacher nahi h sir stock market ko apse best tarike se sikhane ke liye really sir❤❤❤❤

Mr. Dev Chandwani

Sir, Your deep understanding of the Trading Mindset and the way you guide us through every aspect of the learning process is truly remarkable. You have shown us the Importance of building a trader's mentality, ensuring we are prepared to succeed. The mentorship we receive from you is invaluable, and we are truly fortunate to be part of these classes. Thank you so much Sir, May you continue to be blessed

Miss Varghese Joseph

In this market situation, where greed to make profit is at its peak, we are relaxed and calm. Hats off to you Sir, for Teaching us to take proper decisions and book good profit.

Mr. Tushit Agarwal

I was too aggressive over trader like fitting with market every time and finished my complete capital. Thankyou for teaching how to keep patience in any market situation. Now I feel very relaxed and stopped doing over trading.

Mr. Ashish

I have been in the market for around 1-1.5 yrs and whatever you are explaining in this video is exactly what I am experiencing and can surely relate to it. Thank you very much Sir.

HURRY! 77.33% Seats Filled

Who is this for?

- Intraday Traders

- Swing Traders

- Options Traders

- Retired Persons

- Job Going Professionals

- Business Owners

- Investors

- YouTubers

- Students

- Homemakers

- Teachers

- Doctors

- Engineers

- MBAs

- Lawyers

- Marketers

HURRY! 77.33% Seats Filled

Have Questions? Look Here

Frequently Asked Questions

1. What is the duration of the workshop?

The workshop will be for 2 Hours.

2. Do I need to install any software or apps before attending?

You’ll just need a stable internet connection and access to Zoom.

3. Is there a cost to attend the workshop?

No. This workshop is absolutely Free.

4. How can I contact you for more information?

You can reach us through:

Phone/WhatsApp: +91 9970923936

Email: Support@tradelegend.com

5. Where can I access the workshop link?

The workshop link will be sent to your registered email address and WhatsApp number after you complete your registration.

6. Is the workshop live or pre-recorded?

The workshop is conducted LIVE to ensure interactive learning.

7. Do I need any prior trading knowledge to attend?

No prior trading experience is required. The workshop is structured for both Beginners and Advanced Learners.

8. Will I receive any study material?

Yes, attendees will get exclusive access to pre-learning resources, including eBooks and learning videos, some of which will be unlocked after the workshop.

9. Can I invite others to join the workshop?

Absolutely! Feel free to share this page link with anyone interested in learning about trading.

10. Can I access the workshop on mobile?

Yes, the workshop is mobile-friendly. You can join using your smartphone or tablet.

Learn to Follow the Institutions using Price Action

It’s FREE! And takes just 2 minutes to sign up!

Learn to Follow the Institutions using Price Action

It’s FREE! And takes just 2 minutes to sign up!